Why is SRM University-AP the best place for BSc Economics?

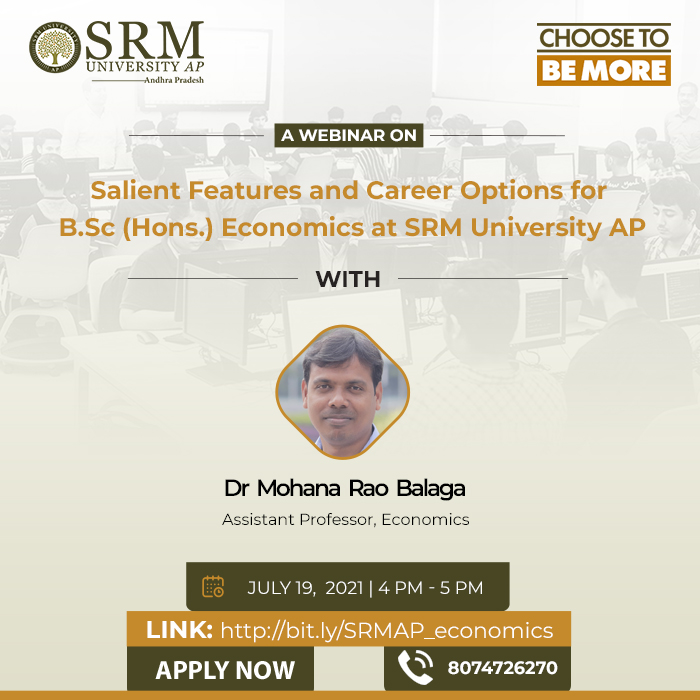

The Department of Economics is hosting a webinar on “Salient Features and Career Opportunities for BSc (Hons) Economics at SRM University AP” on July 19, 2021, at 4.00 pm to discuss the thrust areas of Economics. Dr Balaga Mohana Rao, Assistant Professor in the department, will introduce students to the theoretical and analytical foundations of economics careers.

The Department of Economics is hosting a webinar on “Salient Features and Career Opportunities for BSc (Hons) Economics at SRM University AP” on July 19, 2021, at 4.00 pm to discuss the thrust areas of Economics. Dr Balaga Mohana Rao, Assistant Professor in the department, will introduce students to the theoretical and analytical foundations of economics careers.

In the webinar, Dr Balaga Mohana Rao will detail the industries and job roles available for graduates and discuss the best ways to attain internships and jobs in the industry. Students who choose to pursue a BSc in Economics at SRM University-AP participate in a three-year full-time programme that aims to impart global standards-based curriculum. The objective of the programme is to develop a class of economists who are proficient not just in theory but also in practical expertise to address and analyse real-world problems.

Attend this informative session on July 19, 2021, at 4.00 pm to learn more about the courses, subjects, syllabus, scope, and career opportunities of the BSc Economics course offered in SRM University-AP.

Register here:https://srmap.zoom.us/webinar/register/WN_rYy5kmJvQ6aTJDR73i_-vw

Assessing the benefits of irrigation against heat stress in agriculture

Heat stress negatively affects crop yield and its impact has increased over time. Researchers in India study this situation with utmost priority. Consequently, Dr Ghanshyam Kumar Pandey, Assistant Professor in the Department of Economics at SRM University-AP has co-authored a paper with Pratap S Birthal and et. al titled “Benefits of irrigation against heat stress in agriculture: Evidence from wheat crop in India” in the journal Agricultural Water Management, Vol 255, having an Impact factor 4.02.

Heat stress negatively affects crop yield and its impact has increased over time. Researchers in India study this situation with utmost priority. Consequently, Dr Ghanshyam Kumar Pandey, Assistant Professor in the Department of Economics at SRM University-AP has co-authored a paper with Pratap S Birthal and et. al titled “Benefits of irrigation against heat stress in agriculture: Evidence from wheat crop in India” in the journal Agricultural Water Management, Vol 255, having an Impact factor 4.02.

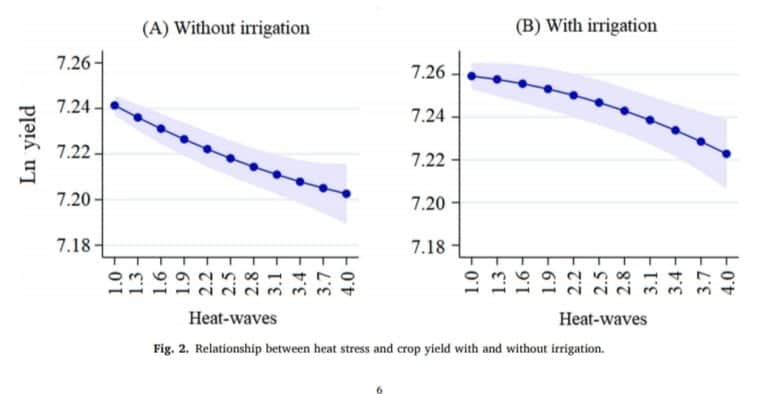

Applying the fixed effects regression technique to the highly spatially disaggregated district-level data from 1966–67 to 2011–12. This paper has assessed the impact of heat stress on wheat production in India and concurrently evaluated the role of irrigation in offsetting its harmful impact. The study has brought out three key highlights:

(i) Heat stress negatively impacts crop yield, and the impact has increased over time.

(ii) Irrigation, besides its contribution towards improving crop yield, also moderates the harmful impact of heat stress, but over time its effectiveness has declined.

(iii) The measure of heat stress built on multiple aspects of excess temperature (i.e., intensity, persistence, and frequency) explains variation in crop yield better than working on a single aspect of it.

Given the increasing scarcity of irrigation water and rising temperature, these findings suggest the need for exploring technological and policy options for improving irrigation water use, efficiency, and breeding of crops for heat tolerance and low water footprints.

This research paper is written in collaboration with ICAR-National Institute of Agricultural Economics and Policy Research, PUSA, New Delhi. Dr Ghanshyam’s future projects are focused on climate change and agriculture, and the effect of climate change on the livestock sector in India.

Read the full paper here: https://doi.org/10.1016/j.agwat.2021.106950

- Published in Departmental News, Economics Current Happenings, Economics News, News, Research News

Dr Balaga Mohana Rao receives Best PhD Thesis award from IIT Bombay

Dr Balaga Mohana Rao, Assistant Professor from the Department of Economics has been awarded the best PhD thesis award in the 59th IIT Bombay convocation held on August 07, 2021. The thesis titled The Early Warnings of the Impending Currency Crises and the Ensuing Macroeconomic Costs aims to develop an Early Warning System to identify the Currency Crises that would help in preventing an impending crisis and also in mitigating the devastating aftermath effects if that occurred.

Dr Balaga Mohana Rao, Assistant Professor from the Department of Economics has been awarded the best PhD thesis award in the 59th IIT Bombay convocation held on August 07, 2021. The thesis titled The Early Warnings of the Impending Currency Crises and the Ensuing Macroeconomic Costs aims to develop an Early Warning System to identify the Currency Crises that would help in preventing an impending crisis and also in mitigating the devastating aftermath effects if that occurred.

The financial crises have enthused a huge theoretical and empirical debate in current times due to their recurrent nature in the history of economics. To highlight the importance of an economic crisis among various sections, Kaminsky et al. (1998) quote Kindleberger (1978) saying that academics are interested in a crisis as they have had a history of fascination for the crises, policymakers are interested because they want to prevent the crisis, and financial market participants are interested as they can make money out of it. The financial crises can be divided into two broad categories—currency and sudden stop crises, and debt and banking crises. The currency crises have not only swept away Argentina (2001), Brazil (1998–1999), Latin America (the 1980s), Russia (1998), Southeast Asia (1997) and UK (1992) (to name a few) but they also have caused serious economic adversities to India and BRICS in the recent past. A currency crisis encompasses one of the following four features or a combination of them owing to a speculative attack—both successful and unsuccessful attacks—on a currency: A sharp depreciation of a currency (possibly followed by devaluation) and/or huge depletion of foreign exchange reserves or an increase in interest rates by the central bank or imposing restrictions on capital flows. In this context, Dr Balaga Mohana Rao’s thesis focuses on developing an early warning system to identify the impending crises, finding the common determinants of currency crises and the aftermath effects on macroeconomic indicators.

“One may wonder why the crisis should be prevented or mitigated. The reason is that a full-blown crisis will not be just confined to the foreign exchange market or some other segment, but it will affect the whole economy” Dr Balaga said. He plans to extend his PhD work on Currency Crises and see it in the context of the International Price System.

- Published in Departmental News, Economics Current Happenings, Economics News, News, Research News

CRIDAP appoints Dr Ghanshyam Pandey as an expert for agriculture

Dr Ghanshyam Pandey, Assistant Professor of Economics, SRM University – AP has been appointed as an expert for agriculture, rural development, livelihood issues, and climate change and agriculture by The Centre of Integrated Rural Development for Asia and Pacific (CRIDAP). CRIDAP is an intergovernmental and autonomous organization and has 15 member countries. The member countries are Afghanistan, Bangladesh, Fiji, India, Indonesia, Iran, Lao PDR, Malaysia, Myanmar, Nepal, Pakistan, Philippines, Sri Lanka, Thailand, and Vietnam. His tenure of appointment will be up to 2024.

Dr Ghanshyam Pandey, Assistant Professor of Economics, SRM University – AP has been appointed as an expert for agriculture, rural development, livelihood issues, and climate change and agriculture by The Centre of Integrated Rural Development for Asia and Pacific (CRIDAP). CRIDAP is an intergovernmental and autonomous organization and has 15 member countries. The member countries are Afghanistan, Bangladesh, Fiji, India, Indonesia, Iran, Lao PDR, Malaysia, Myanmar, Nepal, Pakistan, Philippines, Sri Lanka, Thailand, and Vietnam. His tenure of appointment will be up to 2024.

Dr Ghanshyam Pandey’s role in the organisation:

- CIRDAP resource person to participate in project proposal development and consultancy.

- CIRDAP resource person for flagship training courses.

- Reviewer of Asia-Pacific Journal on Rural Development (APJORD).

- Part of CIRDAP Think Tank for knowledge sharing and solutions to IRD and PA.

- To expand CIRDAP Think Tank Networks.

- To advise on refining CIRDAP Strategic Plan 2020-2024.

About the organisation:

The Centre on Integrated Rural Development for Asia and the Pacific (CIRDAP) is a regional, intergovernmental and autonomous organisation. It was established on 6 July 1979 at the initiative of the countries of the Asia-Pacific region and the Food and Agriculture Organization (FAO) of the United Nations with support from several other UN bodies and donors. The Centre came into being to meet the felt needs of the developing countries at that time as an institution for promoting integrated rural development in the region. From the original six members, CIRDAP has now grown up as a Centre of 15 member countries. The member countries are Afghanistan, Bangladesh (Host State), Fiji, India, Indonesia, Iran, Lao PDR, Malaysia, Myanmar, Nepal, Pakistan, Philippines, Sri Lanka, Thailand and Vietnam. Operating through designated contact ministries and link institutions in member countries, CIRDAP promotes regional cooperation. It plays a supplementary and reinforcing role in supporting and furthering the effectiveness of integrated rural development programmes in Asia and the Pacific.

- Published in Departmental News, Economics Current Happenings, Economics News, News, Research News

Oxford Professor elucidates on the secession with natural resources

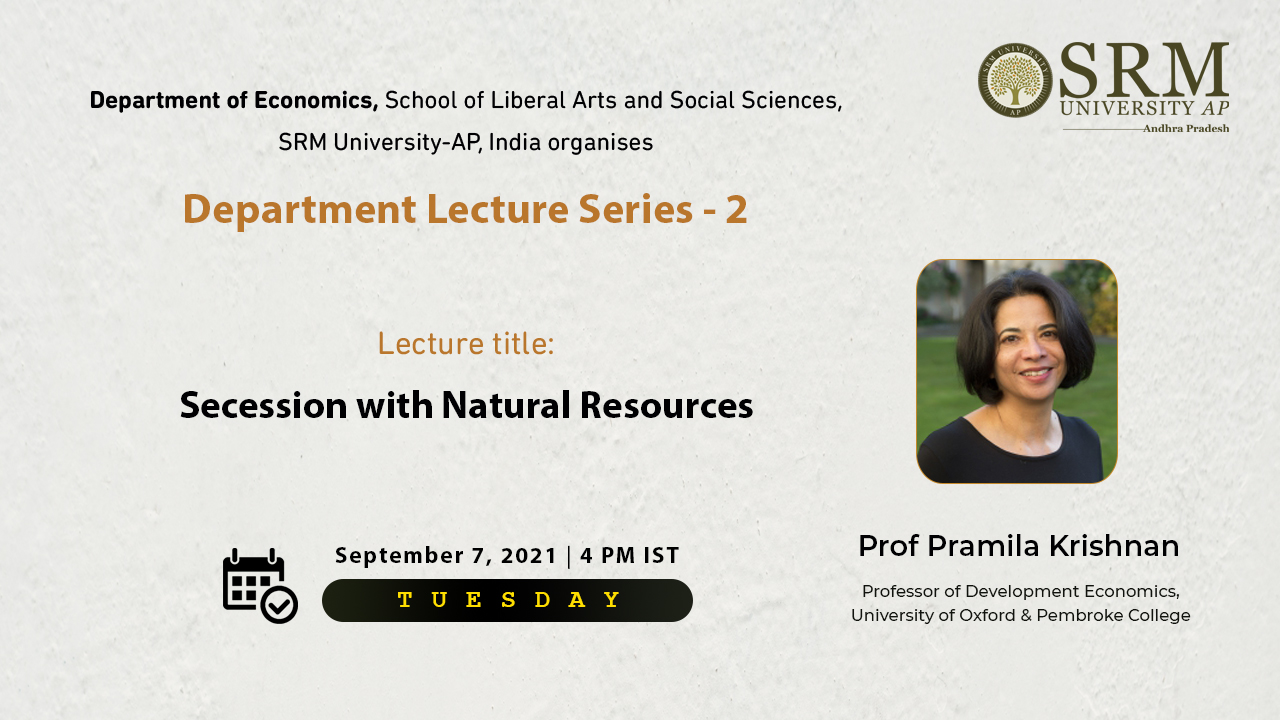

The second episode of the lecture series organised by the Department of Economics, SRM University-AP, will be held on September 07, 2021, at 04.00 pm. The lecture titled “Secession with natural resources” will be delivered by Prof Pramila Krishnan from the Oxford Department of International Development.

The second episode of the lecture series organised by the Department of Economics, SRM University-AP, will be held on September 07, 2021, at 04.00 pm. The lecture titled “Secession with natural resources” will be delivered by Prof Pramila Krishnan from the Oxford Department of International Development.

Abstract:

The lecture will look at the formation of new Indian states in 2001 to uncover the effects of political secession on the comparative economic performance of natural resource-rich and natural resource-poor areas. Resource-rich constituencies fared comparatively worse within new states that inherited a relatively larger proportion of natural resources. The study argues that these patterns reflect how political reorganization affected the quality of state governance of natural resources. Results describe a model of collusion between state politicians and resource rent recipients that can account for the relationships we see in the data between natural resource abundance and post-break-up local outcomes.

About the Speaker:

Pramila Krishnan is a Professor of Development Economics at Oxford Department of International Development, University of Oxford and a Fellow at Pembroke College, Oxford. She began her academic life as an econometrician working on models of self-selection before seeing the light and moving on to work in development economics.

Her research has concentrated on applied microeconomics and she has worked on topics ranging from household portfolios of poor households to risk-sharing, intra-household allocation and informal insurance, social networks, non-cognitive skills and whether migrants might be both rich and happy. Pramila Krishnan teaches on the MSc in Economics for Development, offering a module on education.

Join this intriguing online lecture on September 07, 2021, at 04.00 pm and enrich your knowledge through the scholarly voice of Prof Pramila Krishnan!

- Published in Departmental Events, Economics Current Happenings, Economics Events, Events

Panel Discussion on Union Budget 2022-2023

The department of Economics is bringing forth a panel of economists to discuss the implications of the Union Budget 2022-2023. The panel will confer upon the vision of the new budget and its impact on our society.

The department of Economics is bringing forth a panel of economists to discuss the implications of the Union Budget 2022-2023. The panel will confer upon the vision of the new budget and its impact on our society.

Date: February 09, 2022 (Wednesday)

Time: 2.30 pm IST

The Speakers List

- Prof N R Bhanu Murthy, Vice-Chancellor, BASE University, Bengaluru

- Prof K R Shanmugam, Director, Madras School of Economics, Chennai

- Prof K Gayithri, Professor, Institute for Social and Economic Change (ISEC), Bengaluru

- Dr Shri Hari Naidu, Economist, National Institute of Public Finance and Policy (NIPFP), New Delhi

Moderator

- Prof Bandi Kamaiah, Emeritus Professor, University of Hyderabad

Convenor of the Event

- Dr Anandarao Suvvari, Faculty Coordinator, Economics Department, SRM University-AP

Co-Convenors of the Event

- Dr Ghanshyam Pandey, Assistant Professor, Economics Department, SRM University-AP

- Dr Manzoor Hassan Malik, Assistant Professor, Economics Department, SRM University-AP

- Dr Kamal Sai Erra, Assistant Professor, Economics Department, SRM University-AP

- Mr Hari Venkatesh, Assistant Professor, Economics Department, SRM University-AP

Join the session to learn more about how the Union Budget 2022-2023 will affect you along with the rest of the country.

- Published in Departmental Events, Economics Current Happenings, Economics Events, Events

Budget Panel Discussion 2022-23

The Department of Economics of SRM University-AP, Andhra Pradesh, conducted a Panel Discussion on February 09, 2022, for the much needed and relevant in-depth analysis of the Union Budget proposed by the Finance Minister in the parliament on February 01, 2022.

The Department of Economics of SRM University-AP, Andhra Pradesh, conducted a Panel Discussion on February 09, 2022, for the much needed and relevant in-depth analysis of the Union Budget proposed by the Finance Minister in the parliament on February 01, 2022.

Professor Bandi Kamaiah was the moderator of the event, and Dr Anandarao Suvvari, the faculty coordinator of the Department of Economics in the University, organised this discussion, inviting four eminent public finance economists of India, Prof N R Bhanu Murthy, Vice-Chancellor, BASE University, Bengaluru; Prof K R Shanmugam, Director, Madras School of Economics, Chennai; Prof K Gayathri, Professor, Institute for Social and Economic Change (ISEC), Bengaluru; Dr Shri Hari Naidu, Economist, National Institute of Public Finance and Policy (NIPFP), New Delhi. The co-convenors of the event were Dr Ghanshyam Pandey, Dr Manzoor Hassan Malik, Dr Kamal Sai Erra, Dr Hari Venkatesh from the Department of Economics SRM-AP.

The discussion started with a brief overview and essence of the Union budget by Dr Anandarao Suvvari, followed by Prof Bandi Kamaiah. Then first panellist Prof N R Bhanu Murthy, who our Indian Finance Minister also quoted, spoke about how the current budget is a continuation of the previous budget and emphasised more on the capital expenditure, which is the route to growth. He highlighted that the government should bring efficiency in public expenditure and expressed that the public policymakers side-lined the public debt number to GDP ratio at both central and state levels. An issue identified by Prof Murthy was bringing in many commodities under the customs tariff line and how doing this will have a negative impact on the exports. Further, he mentioned the ignorance towards the health and education sectors by a reduction in the allocation of expenditure for the same.

The second panellist Prof K R Shanmugam, gave a very detailed look at the budget, sector by sector, pointing out the benefits and the concerns related to each of them. He gave us a brief look at how the Indian economy has been doing for the past few years and gave an analysis taking this into consideration and stated that the budget had provided necessary fiscal stimuli through an increase in capital expenditure for the revival of the economy.

The third panellist Prof K Gayathri highlighted the philosophy of policy implications of budget and the need for a continuous process for analysing it. She also focused on the need for scientificity for estimates and the need for a sustainable approach for the budget. She pointed out that the current budget was future-looking in line with the vision for India 100 and that it put thorough emphasis on capacity building inclusive development by involving all stakeholders and modern infrastructure while expressing concern over effective implementation of policies.

The final panellist, Dr Shri Hari Naidu, discussed the revenue side of the budget thoroughly while focusing on the new taxation regime, other and legitimising crypto assets and digital Indian currency. In addition to this, Dr Naidu commented on the budget that the tax GDP ratio has been stagnant for the past two decades also, it has not been addressed in the budget, and despite the fact that there were a lot of tax reforms, the tax bases needed to be expanded.

After individual reviews by the panellists, questions posed by the students and the co-convenors were answered, followed by an interactive and engaging discussion among panellists, moderator, convenor and co-convenors on various issues spanning from the way of analysing the budget, trade-offs between debt and capital expenditure, debt sustainability, control mechanisms, the process of allocation, outcome evaluation or impact of the budget and the need for reality and effectiveness of planned budget on the ground level.

The session, after a thorough discussion on the union budget, was concluded by a vote of thanks proposed by Asst. Prof. Dr Hari Venkatesh to the esteemed panellists, moderator, convenor, co-convenors and all the people who made this session successful for contributing their precious time and valued efforts.

- Published in Departmental News, Economics Current Happenings, Economics News, News

Tenancy and Credit: Exploring Facts below the Crust in AP

SRM University-AP is proud to announce that Dr Ghanshyam Kumar Pandey, Department of Economics, has received the prestigious NABARD (National Bank for Agriculture and Rural Development) grant of Rs 14.85 lacs for a duration of 10 months of active research on “Tenancy and Credit: Exploring Facts below the Crust in AP”.

SRM University-AP is proud to announce that Dr Ghanshyam Kumar Pandey, Department of Economics, has received the prestigious NABARD (National Bank for Agriculture and Rural Development) grant of Rs 14.85 lacs for a duration of 10 months of active research on “Tenancy and Credit: Exploring Facts below the Crust in AP”.

About the Research

The study will attempt to identify different possible sources of credit of agriculture households in the Guntur district of AP and then an analysis of the impact at the macro level will be carried out. The role of self-help groups and microfinance on agriculture and livelihood will be one important component of this analysis. Transaction cost, cascading effect, and loan waiver impact will be estimated across tenant and owner cultivators, and social groups.

The study will help to understand the improvement in the life of tenants due to the adoption of the ‘Model Tenancy Act’ and provide feedback on the Tenancy Certificate introduced in AP for enabling farmers to access bank/formal credit and whether the formation of JLGs has led to increase in the credit availability to tenants or not.

The project will help understand the sociological impact of economic decisions by the governance and help direct policies to more beneficial outcomes especially in terms of Tenancy and Credit.

- Published in Departmental News, Economics Current Happenings, Economics News, News

Effects of Covid-19 on mental health

The Department of Economics is delighted to announce that Dr Ghanshyam Kumar Pandey and his research group; Sheeba Moghal, Rakshit Barodia, and William Carey have published an article titled “COVID-19 and its effects on the mental health of people living in urban slums in India” in the ‘Journal of Information and Knowledge Management’, having an Impact Factor of 1.3.

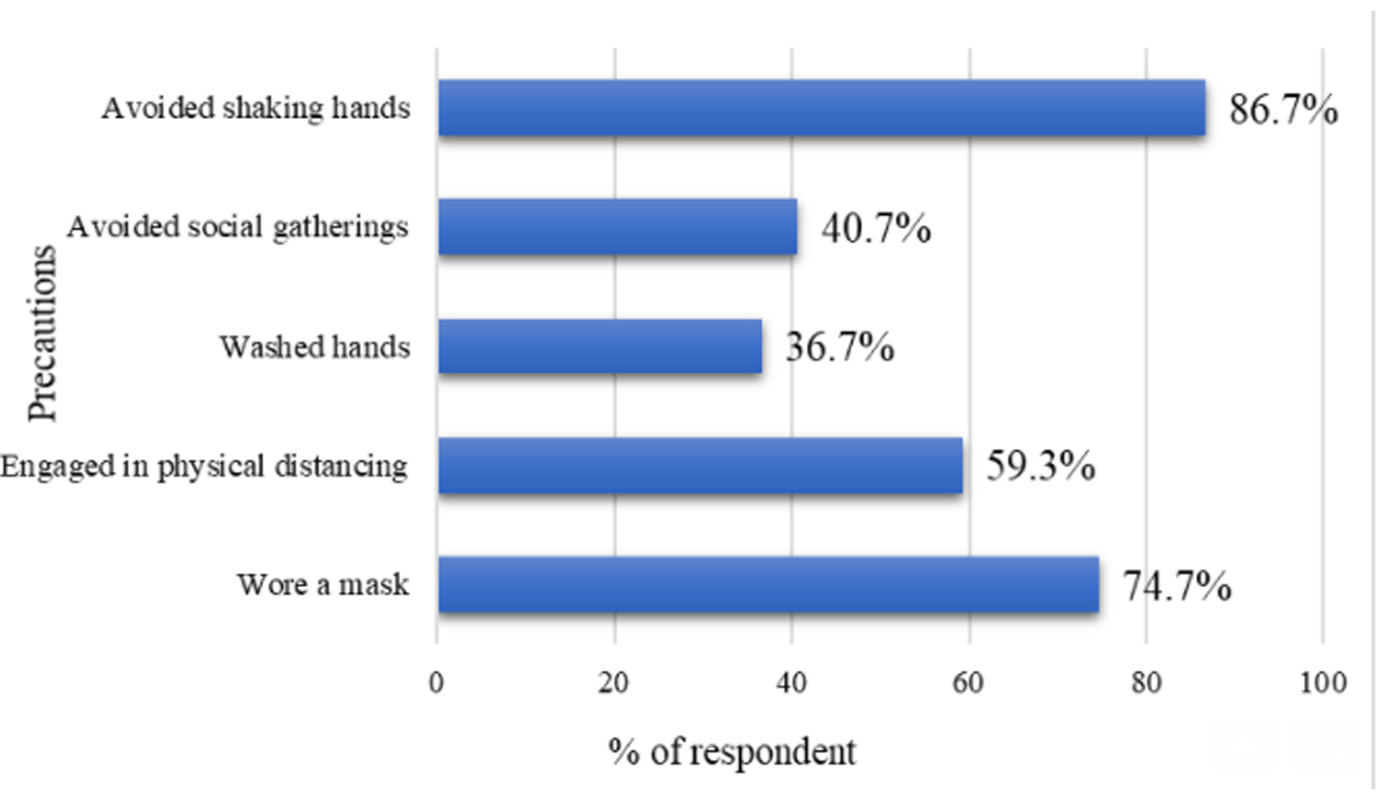

The study confirms that more than three-fourth of the population suffer from mental stress due to the spread of COVID-19 and the lockdown imposed by the government. Eighty per cent of those surveyed stated that the stress had affected their decision-making. The study also confirms that the number of dependents, monthly income, number of living rooms, maintenance of physical distancing norms, avoidance of social gatherings, government support, health insurance, and living in a rented house are significantly related to the mental stress of people living in slums in Andhra Pradesh in India.

Abstract of the Research

The COVID-19 pandemic has had a devastating effect on the mental health of people from different backgrounds; these effects have been particularly acute among lower-income households and in slums. There has been a steep rise in mental illness and behaviours associated with it since 2020, especially in slums characterized by poverty, poor housing, high density, and unhealthy environments. This paper aims to examine the effect of COVID-19 on the mental health of people living in the slums of Vijayawada and Visakhapatnam in the state of Andhra Pradesh in India.

- Published in Departmental News, Economics Current Happenings, Economics News, News, Research News

IUP publications features an interview with Prof Bandi Kamaiah

‘An interview with Professor Bandi Kamaiah’ was featured in the leading publication, IUP Journal of Applied Economics. Analysing the issues of Micro, Macro, Development and Energy economics, the journal features papers on Industrial economics, Public finance, Industry, Agricultural, Rural economics, etc. Having published interviews with eminent Professors like Professor K L Krishna, Professor Dilip Nachane, Professor U Sankar, Professor S Mahendra Dev, and Professor Ashima Goyal, the dialogue with Prof Bandi Kamaiah is the sixth in the series.

In the interview with Prof Bandi Kamaiah, Department of Economics, SRM University-AP, GRK Murty narrates the transformational journey of Prof Kamaiah from the son of a tenant farmer to an estimable researcher who went on to occupy the position of the President of ‘The Indian Econometric Society’ (TIES). The interview presents an enriching account of the veteran’s life who crossed innumerable hurdles to nurture his passion and became an ‘agent of change’ in the lives of several hundreds of first-generation students from the margins of society, by shaping them into accomplished professionals.

The evocative dialogue with Prof Kamaiah extends an open doorway to several inspiring phases of his life that modelled him into a “towering intellectual” and “outstanding teacher”. His collaboration with pre-eminent economists like Prof P R Bramhananda, Prof Dilip Nachane, and Prof C Rangarajan motivated him to build a career in monetary economics. He has successfully guided 50 PhDs and an equal number of MPhil dissertations from almost every facet of economics and published more than 160 papers in national and international journals.

The interview explicates his association with various institutes of prestige including the National Institute of Bank Management (NIBM), Indira Gandhi Institute of Development Research (IGIDR) and the University of Hyderabad. As the founding father of the School of Economics at the University of Hyderabad, he has also introduced a two-year employment-enhancing master’s program in Financial Economics. His amicable and free-spirited approach made him one of the most sought-after teachers among the student community. He has a unique way of nurturing students and guiding them through the process of academic research.

Prof Kamaiah also articulates his views on the economic landscape of the country, the possible impact of its monetary and fiscal policies in the post-pandemic scenario, the growing correlation between the domestic and global stock markets, and the deepening relationship between energy consumption, real GDP, CO2 emissions, and such other climate-related issues. Airing his concerns about the outmoded syllabus and stagnant curriculum, he reiterates the need to renovate university education, hopefully, through the framework created by NEP 2020. He believes, creating specialised institutions would be a better way to train professionals who would become market ready and employable.

In his opinion, ‘Centres of Economic Excellence’ in different regions of the country will give rise to a strong pool of economists well-trained within the country to meaningfully replace the imported economists from the West to render advice on crucial matters. “The young minds of the country should be exposed to indigenous ways of thinking, and holistically trained to appreciate our culture, resources and institutions, systems and customs, ways of living, etc. to understand local markets, expose the basis of vulgar consumerism, the beauty of self-regulation without the aid of Adam Smith’s invisible hand, and social realism in contrast to self-interest”, said Prof Kamaiah.

- Published in Departmental News, Economics Current Happenings, Economics News, News