The rate of inflation has been termed to be directly proportionate to economic activity, with the increase in economic activity leading to higher levels of inflation. Central Banks have used this relationship to formulate interest rates and understand the inflation–unemployment dynamics in many countries. Dr Adviti Devaguptapu, Assistant Professor from the Department of Economics, has published an interesting study in her paper titled “Phillips Curve in Canada: A Tale of Import Tariff and Global Value Chain”, where she examines the relationship between inflation-economic activity in Canada to better understand the correlation between inflation and unemployment rates.

Abstract

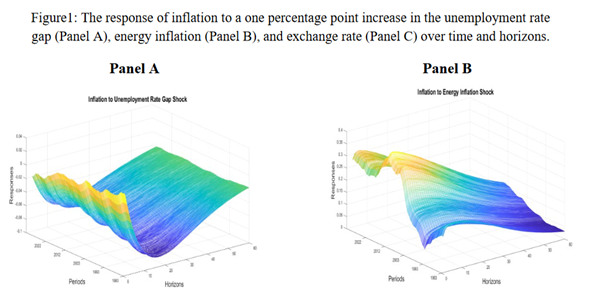

The paper examines the Phillips curve for Canada from June 1976 to October 2022 in a time-varying manner. The findings reveal that the impulse response of inflation to the changes in the unemployment rate gap has reduced over time till 2010 and strengthened thereafter. The response of inflation to the changes in the unemployment rate gap has increased in short and medium horizons after 2010. On further examination, it is found that the changes in both average import tariff and forward participation in the global value chain have reduced the inflation response to the changes in the unemployment rate gap.

Social Implications of the Research

Inflation-targeting central banks should have to put more (less) effort into achieving price stability in the medium run when the change in the level of inflation to the changes in the unemployment rate gap is more (less).

Dr Adviti’s research works towards developing quality-adjusted inflation in India – the need for it and the challenges in recording it.

Link to the article