We are thrilled to announce that Dr Sunil Chinnadurai, Associate Professor in the Department of Electronics and Communication Engineering has published a significant research paper titled “Ethereum Blockchain Framework Enabling Banks to Know Their Customers” in the esteemed journal IEEE Access. In his paper, Dr Chinnadurai explores the innovative applications of Ethereum blockchain technology in enhancing customer verification processes within the banking sector. His research addresses the growing need for robust and secure methods for banks to comply with Know Your Customer (KYC) regulations while ensuring customer privacy and data integrity.

We are thrilled to announce that Dr Sunil Chinnadurai, Associate Professor in the Department of Electronics and Communication Engineering has published a significant research paper titled “Ethereum Blockchain Framework Enabling Banks to Know Their Customers” in the esteemed journal IEEE Access. In his paper, Dr Chinnadurai explores the innovative applications of Ethereum blockchain technology in enhancing customer verification processes within the banking sector. His research addresses the growing need for robust and secure methods for banks to comply with Know Your Customer (KYC) regulations while ensuring customer privacy and data integrity.

This pioneering work contributes to the ongoing discourse on digital transformation in the banking industry and presents a framework that could potentially revolutionise customer onboarding and identity verification practices.

We extend our congratulations to Dr Chinnadurai for this remarkable achievement and look forward to his continued contributions to the field of electrical and electronics engineering. His research not only enhances the academic reputation of SRM University-AP but also paves the way for innovative solutions in the financial sector.

Abstract of the Research

This paper looks at how blockchain technology can improve the Know Your Customer (KYC) process. It aims to make things more open, secure, and unchangeable. Banks can use the Ethereum blockchain to get and keep customer information, which saves time and money. The solution tries to solve problems with KYC procedures making sure banks follow the rules and stop fraud. The central bank will keep a list of all banks and check if they’re doing KYC right. This spread-out approach gives banks a good long-lasting way to bring in new customers.

Explanation of the Research in Layperson’s Terms

Our study seeks to cause a revolution in the Know Your Customer (KYC) process for banks using Ethereum blockchain technology. Current KYC methods take too long, cost too much, and leave room for cheating. Blockchain offers a clear, safe, and unchangeable platform to store customer data letting banks check and confirm identities. This spread-out approach means customers only need to complete the KYC process one time, which saves a lot of time and money for both banks and customers. Also, blockchain’s safety features make sure that private data stays unchanged and safe from people who shouldn’t see it. Our planned system involves the central bank keeping a full list of all banks and watching to make sure they follow KYC rules. In the future, we plan to put our solution on the real Ethereum network and build a working decentralized app. This system promises to make KYC processes faster, safer, and cheaper, giving a strong answer for banks all over the world.

Practical Implementation or the Social Implications associated

Our research puts blockchain tech to work to improve how banks verify customers. This decentralized system gives everyone access to the same current info through a shared record. This cuts down on middlemen and their costs. Smart contracts that run on their own speed up checks with less human involvement. This lowers the chance of data getting out. It makes transactions faster and keeps data safe from changes it shouldn’t have. This new way of checking customers can save money, make customers happier, and follow rules better. It can make people trust banks more by keeping data safer and being more open. It also means banks don’t have to do the same checks over and over, which is better for them and their customers. In the end, our blockchain answer for customer checks aims to make banking safer, smoother, and cheaper. It should also help build more trust in banks overall.

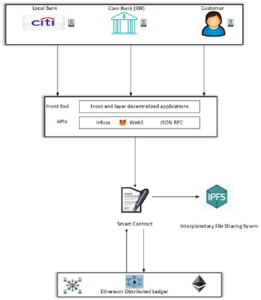

FIGURE 1. Implementation of a blockchain-based KYC process

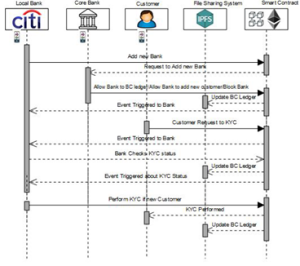

FIGURE 2. Sequential flow diagram illustrating the proposed KYC process using blockchain technology

Future Research Plans

We’re planning to test our idea a lot on the Ethereum network to make sure it works well. We want to build a working DApp that shows our KYC system is doable. We’ll check if people might use it and look at how safe and private it is. By doing this, we hope to make a strong and reliable DApp that’s easy to use, open, safe, and quick. In the end, we want to create something that makes KYC better and sets a new bar for money stuff making banking safer and faster for everyone. Our main goal is to make a system that does not improve how KYC works but also changes how money moves around, making sure banks are safer and work better for people.